The banking world is not just adopting artificial intelligence—it’s being reshaped by it. As we move through 2025, banks that leverage AI are outperforming those that don’t. From fraud detection to personalized banking assistants, AI is no longer optional, it’s foundational.

In this blog, we’ll explore 8 cutting-edge AI use cases revolutionizing banking, backed by real-world examples, credible sources, and insights you can apply.

Table Of Contents

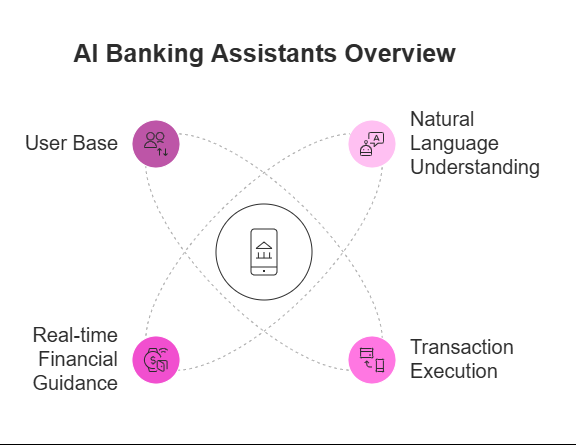

AI Banking Assistants That Never Sleep

The rise of Large Language Models (LLMs) has enabled banks to deploy AI assistants that understand natural language and serve millions of customers at once. Wells Fargo’s Fargo AI, powered by generative AI, can:

- Answer account-related queries

- Execute transactions via chat

- Provide financial guidance in real-time

📊 Over 25 million users now rely on Fargo for daily banking. And it’s not alone—Bank of America’s Erica is another leader in this space.

Hyper-Personalized Money Coaching

In 2025, financial wellness is a top priority. AI personal finance coaches analyze:

- Spending patterns

- Income sources

- Lifestyle goals

…to offer proactive, personalized advice. Wells Fargo, Bank of America, and Revolut now offer built-in AI tools that act like virtual financial advisors.

These tools have helped boost financial literacy, especially among Gen Z users.

Fraud Detection at Lightning Speed

AI systems now flag suspicious activity within milliseconds, far surpassing legacy rule-based systems. Mastercard’s Decision Intelligence, for example, uses AI to detect:

- Unusual locations

- Device mismatches

- Abnormal purchase patterns

…before fraud even happens.

Testing with Synthetic Customers

Before rolling out services, banks now use AI-generated synthetic personas to simulate real customer behaviors.

The Commonwealth Bank of Australia (CBA) pioneered this to understand how different demographics respond to:

- Economic stress

- Product offerings

- UI/UX changes

🔗 Learn more from the World Economic Forum.

This dramatically improves product-market fit without exposing real customer data.

Filtering Abusive Messages in Transactions

Yes, AI is even protecting users from harassment. CBA uses Natural Language Processing (NLP) to scan and block abusive messages sent via transaction notes—especially in peer-to-peer payments.

It’s a real-world example of AI improving financial safety and inclusion.

These models are also now open-source, allowing smaller banks to adopt the same protection standards.

GPT-Driven Investment Advisors

JPMorgan’s IndexGPT, a GPT-powered tool for investment decision-making, was one of the first finance-sector GPTs in the market. Now in 2025, many banks are following suit.

These AI tools help users:

- Build personalized portfolios

- Monitor market conditions

- Rebalance investments based on goals and risk

This is the future of robo-advisory—hyper-personal, adaptive, and available 24/7.

🔗 Read more from Bloomberg.

Voice-Activated Banking Assistants

Banks like Bunq and Monzo now embed voice assistants directly into their mobile apps.

Example commands:

- “Transfer $100 to my savings”

- “What’s my balance this week?”

- “Set up a recurring bill payment”

Voice interfaces improve accessibility, especially for visually impaired and elderly customers.

AI-Powered Security for Online Payments

Platforms like PayPal and Stripe use AI to analyze billions of transactions in real-time. Their systems:

- Detect irregular purchases

- Monitor device activity

- Flag suspicious IP addresses

This prevents payment fraud before it happens, ensuring safe, seamless digital commerce.

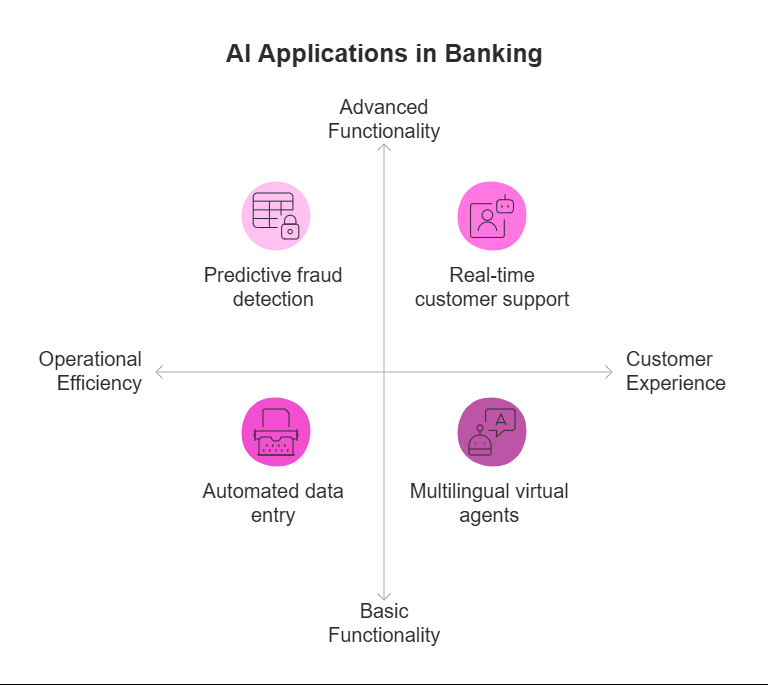

Why Use AI in Banking?

AI is no longer a futuristic luxury — it’s a competitive necessity in the financial sector. Banks today deal with mountains of data, millions of daily transactions, and rising customer expectations for speed, personalization, and security. AI helps solve these pain points by:

- Automating repetitive operations (data entry, compliance checks, loan processing)

- Reducing operational costs by 20–25% through intelligent task handling

- Enhancing customer experience with real-time service and support

- Improving fraud detection with predictive models and anomaly detection

- Supporting financial inclusion via multilingual, accessible virtual agents

Suggested reading: How AI is transforming banking.

Challenges of Using AI in Banking

Even though the benefits are compelling, deploying AI comes with its own set of challenges:

- Data Quality & Bias: Incomplete or biased data can misguide AI predictions

- Ethical Risks: AI decisions must be transparent, fair, and explainable

- Integration Complexity: Legacy systems can slow down AI deployment

- Security Concerns: AI systems themselves can become targets for adversarial attacks

- Regulatory Compliance: Constantly evolving financial laws require adaptable AI systems

Tip: Mitigate these risks by using trustworthy platforms like Cubeo AI, which offer auditability and no-code controls for secure agent development.

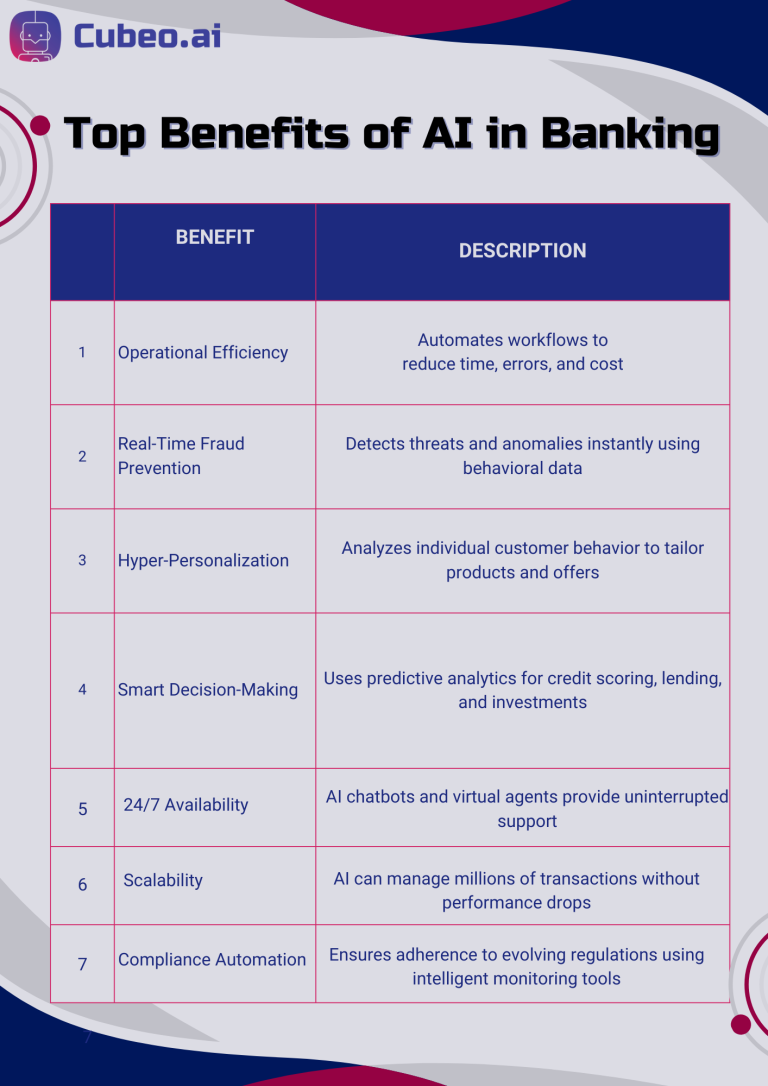

Top Benefits of AI in Banking

What’s Next? Future Trends in AI for Banking

- AI-Driven ESG Investing: Align portfolios with sustainability using AI

- Voice Biometrics & AI Authentication: Replace passwords with speech recognition

- Embedded AI in Wearables: Predict spending behavior using health or mood data

- Quantum-Ready AI Models: Turbocharge AI decision-making for high-stakes trading