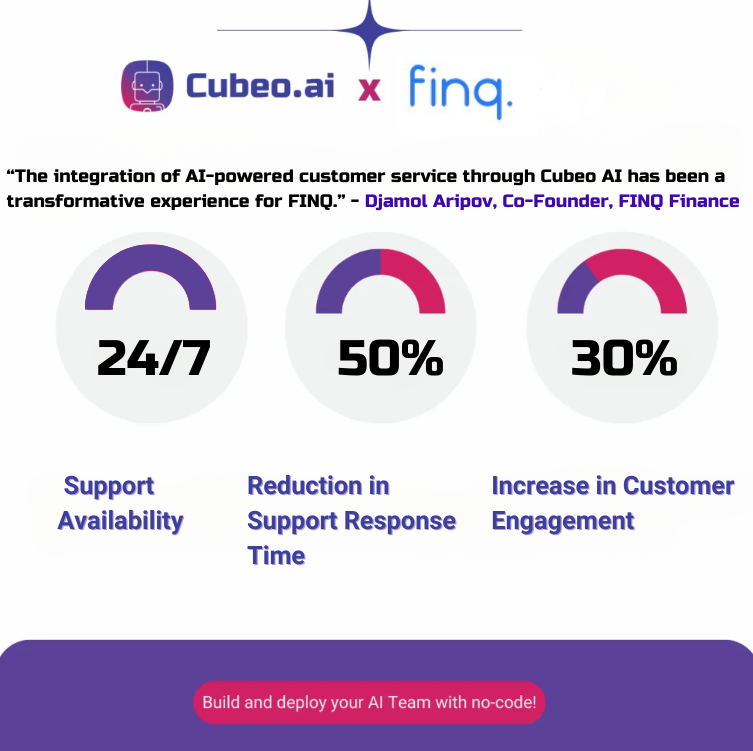

“Partnering with Cubeo AI was a turning point for FINQ Finance. The ability to automate and personalize customer interactions has improved our efficiency and drastically reduced wait times for users. We’ve seen a 30% increase in engagement and can now support our customers 24/7 with ease. It’s a smart solution that has enhanced every aspect of our service.”

– Djamol Aripov, Co-Founder, FINQ Finance.

Table Of Contents

Client Background

FINQ Finance, a fintech company based in Tashkent, Uzbekistan, is revolutionizing personal finance through its mobile platform. With services focusing on credit monitoring, loan management, and personalized financial products, FINQ empowers users to take control of their financial health and improve their credit scores.

However, with a rapidly growing customer base, managing large volumes of user inquiries became challenging, leading to the need for a scalable, efficient solution to streamline customer engagement and improve service delivery.

Challenge

FINQ Finance’s customer support team faced increasing pressure from high volumes of repetitive queries about loan eligibility, credit monitoring, and product recommendations. With growing demand, maintaining high service standards was difficult without significantly expanding the support team. To ensure scalability and improve response times, FINQ sought a technology solution that could automate routine inquiries while maintaining a high level of personalization.

Solution

FINQ implemented an AI-powered chatbot to automate and enhance customer service. The chatbot integrated seamlessly into FINQ’s mobile platform and provided immediate, accurate responses to user inquiries, covering everything from loan recommendations to credit score analysis.

The AI chatbot’s features included:

- Credit Monitoring Assistance: Users could inquire about their credit scores and receive personalized advice on improving them.

- Loan Matching: The AI chatbot provided tailored loan product recommendations based on users’ financial data and credit scores.

- 24/7 Availability: The chatbot offered round-the-clock assistance, ensuring users received support at any time.

- Natural Language Processing (NLP): Powered by advanced NLP, the chatbot could understand complex financial queries and provide conversational, human-like responses.

The chatbot not only automated customer service but also enhanced the user experience by delivering personalized financial insights.

Implementation

The AI chatbot was deployed within FINQ’s mobile app, allowing users to interact in real-time with a virtual financial assistant. This virtual assistant handled tasks like:

- Guiding users through credit score inquiries.

- Suggesting loan products based on real-time credit assessments.

- Providing status updates on loan applications and repayment schedules.

By automating routine tasks, the AI chatbot reduced the workload on FINQ’s human support agents, allowing them to focus on more complex inquiries.

Results

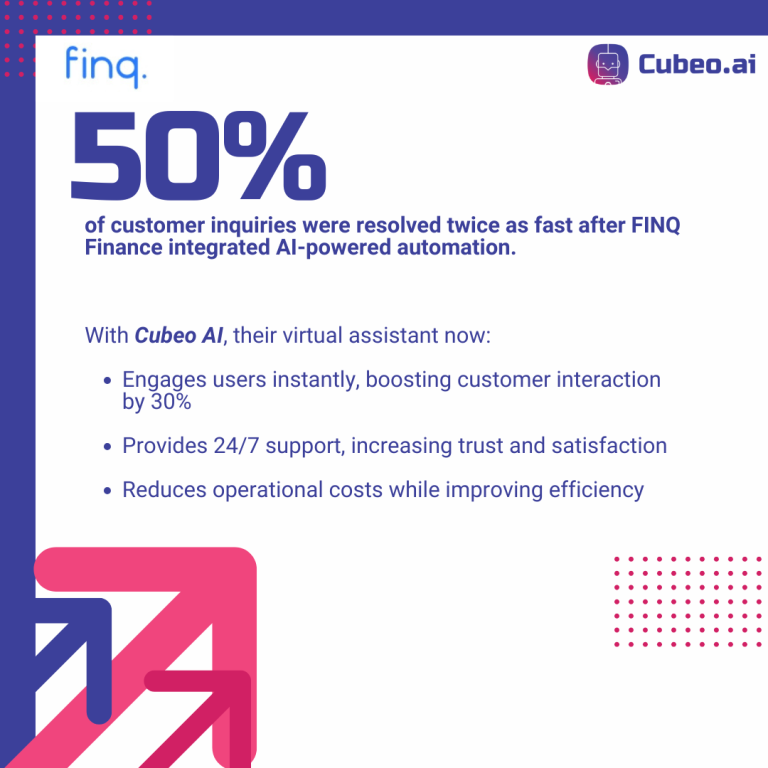

FINQ Finance saw transformative results after deploying the AI-powered chatbot:

- 30% Increase in Customer Engagement: The AI chatbot’s ability to provide instant responses encouraged users to engage more frequently with the app, leading to a 30% rise in customer engagement.

- 50% Reduction in Support Response Time: With the chatbot handling repetitive queries, response times for customer inquiries were halved, greatly improving user satisfaction.

- 24/7 Support Availability: Users could now access financial assistance anytime, which boosted customer trust and loyalty.

- Reduced Operational Costs: Automating customer service allowed FINQ to scale its operations without the need to expand the support team, reducing overhead costs while improving service delivery.

Key Features

- Real-Time Credit Advice: Users received up-to-date credit score reports and personalized improvement tips.

- Loan Product Matching: Tailored financial product recommendations based on each user’s profile.

- Continuous Support: The chatbot provided around-the-clock assistance, ensuring that user queries were addressed instantly.

- NLP-Driven Conversations: Through sophisticated AI, the chatbot offered conversational responses, providing users with a human-like experience.

Co-Founder Testimonial: “Implementing an AI-powered chatbot was a game-changer for us at FINQ. It not only improved our customer support by reducing response times but also allowed us to scale quickly without needing to increase our support staff. The AI chatbot handles everything from simple loan inquiries to complex credit advice, making it an indispensable tool for our operations.”

– Djamol Aripov, Co-Founder, FINQ Finance.

Client Testimonial

“The AI chatbot has completely transformed how we manage customer queries. Our users now get immediate responses, and the personalized loan recommendations have improved both client engagement and satisfaction. It’s been a fantastic addition to our platform.” – CEO, FINQ Finance

Conclusion

The integration of the AI-powered chatbot has revolutionized FINQ Finance’s customer service, allowing the company to enhance engagement, reduce response times, and scale its operations efficiently. With a 30% increase in customer engagement and a 50% reduction in response time, FINQ’s AI chatbot has provided a scalable, cost-effective solution that continues to enhance the customer experience.

The Future with AI

Building on the success of its AI chatbot, FINQ Finance plans to further integrate AI-driven solutions into its platform. This includes expanding the chatbot’s capabilities to offer more personalized financial advice and integrating predictive analytics for better loan and credit management. With AI, FINQ aims to continuously improve the financial lives of its users while staying at the forefront of fintech innovation in Uzbekistan.